Does Personal Capital Make Money: How to make money with money

02/10/22

Table of Contents

The personal finance industry is a multi-billion dollar economic powerhouse. It is one of the largest industries in the world, with an annual turnover rate of $10 trillion (from Financial Times). The sector includes banking and lending, financial advising, insurance sales, and pensions.

What might this mean for you? Quite simply: money! Personal capital makes money when people invest in stocks or bonds, buy life insurance, take out loans to buy cars, college tuition, or homes; when they save for their retirement years.

Personal Capital is More than the $20 Bill You Hide in Your Wallet

Making money is all about being proactive and taking advantage of every opportunity that comes your way. If you have some extra cash lying around, you can use it to make more money. Here are a few ideas for how to do just that:

– Invest in stocks or bonds: This is a great way to make money over the long term. When you invest in stocks or bonds, you’re essentially lending your money to a company or government in exchange for a return on your investment.

– Start a business: A great way to make more money is to start your own business. This can be a great way to achieve financial independence and earn more money than you would be working for someone else.

– Save for retirement: If you’re not ready to retire yet, consider saving some of your money later.

– Invest in real estate: This is a great way to make extra cash flow and build wealth over time. It’s also one of the safest investments you can make, as long as you do it right!

Financial Accounts? Got Some? Get Some!

There are a variety of financial accounts you can use to make money. Here are a few of the most common:

Checking account:

A checking account is a basic bank account that allows you to access your money quickly. This is an excellent option for everyday expenses and transactions.

Savings account:

A savings account is a bank account that allows you to save money. This is an excellent option for short-term savings goals and building your emergency fund.

Investment account:

An investment account is a bank account that allows you to invest your money in stocks, bonds, or mutual funds. This is an excellent option for long-term savings goals and building your retirement fund.

Certificate of deposit (CD):

A CD is a bank account that allows you to save money for a specified amount of time. This is an excellent option if you want to grow your money over time and earn interest.

Money market account:

A money market account is an investment product that allows you to invest in stocks or bonds with less risk than other investments while still earning a higher return than a savings account.

401(k):

A 401(k) is an employer-sponsored retirement savings plan that allows you to save money for retirement. This is an excellent option if you want to save money on taxes and have it automatically deducted from your paycheck.

IRA:

An IRA (individual retirement account) is a retirement savings plan that you can open independently. This is an excellent option if you want to save money on taxes and have more control over how your money is invested.

529:

A 529 account is an education savings account that allows you to save money for your child’s college expenses. This is an excellent option if you want to save money on taxes and get a tax break for your child’s education expenses.

Home equity loan:

A home equity loan is a loan that allows you to borrow money against the value of your home. This is an excellent option if you need cash for a large purchase or if you want to consolidate debt.

You Need a Financial Advisor

A financial advisor is a professional who helps you manage your money and achieve your financial goals. They can help you create a budget, invest in stocks and bonds, and save for retirement. They can also help you find ways to reduce your expenses and get out of debt. Financial advisors can be helpful for people of all ages and income levels.

Using Your Capital and a Retirement Planner

When it comes to saving for retirement, there are two main options: personal investments or retirement funds. Here’s a look at the pros and cons of each:

Personal Investments

Pros:

– More control over how your money is invested.

– Choose from a variety of investment options.

– You can typically earn a higher return on your investment than you would with a retirement fund.

Cons:

– Experience more volatility with your investment portfolio.

– You may have to do more research to find suitable investment options.

– Pay more in fees than you would with a retirement fund.

Retirement Funds

Pros:

– Money is automatically invested in a variety of investment options.

– Typically don’t have to do any research to find good investment options.

– Your money is more diversified, which can help reduce your risk.

Cons:

– Not as much control over how your money is invested.

– May not be able to choose from as many investment options.

– Earn less of a return on your investment than you would with personal investments.

Investing Personal Capital Offers You Freedom, But is there a higher risk?

Investing personal capital is how you can make more money with the same amount of work. You can increase your income and save for retirement without increasing how much time you spend working. But there’s also a higher risk with investing personal capital-if something goes wrong. It could cost you everything!

The best way to make sure this doesn’t happen is by having a solid financial foundation. Here’s how you can do that:

– Create a budget and stick to it.

– Invest in stocks and bonds.

– Find ways to save money on everyday expenses (including cutting out cable, switching cell phone providers, etc.).

Working with Wealth Management Services

A wealth management service is a professional who helps you manage your money and achieve your financial goals. They can help you create a budget, invest in stocks and bonds, and save for retirement. They can also help you find ways to reduce your expenses and get out of debt. Wealth management services can be helpful for people of all ages and income levels.

There are many different ways to do it when it comes to making money. You need to find the right one for you! If you’re unsure how to get started, working with wealth management services can be a great option. Wealth management services can help you create a budget, invest in stocks and bonds, and save for retirement. If you’re looking for how to make money with money, this is a great place to start.

Wealth management services can be helpful for people of all ages and income levels. Working with a wealth management service is a great way to do it if you’re looking to get ahead financially!

Do a Yearly Personal Capital Review

You don’t have to make money with personal capital every year. But I would encourage you to do a yearly review of how much cash is in your account and how well your investments are performing. If there’s been any change (good or bad), it might be time for an adjustment!

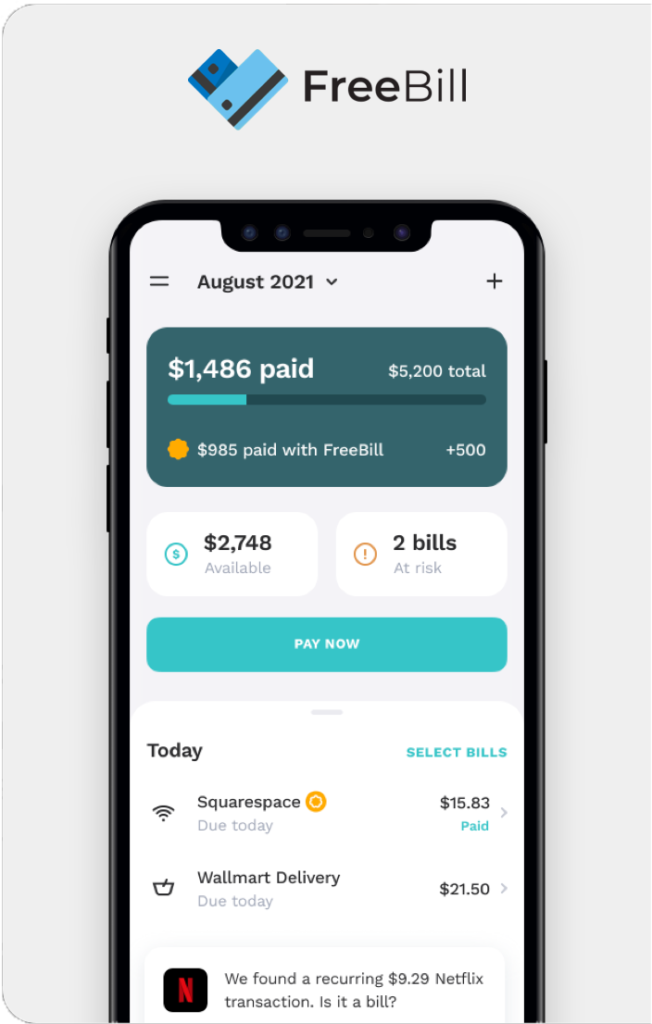

Managing Your Investment Accounts with a Personal Capital App

Several investment apps can help you manage your money and invest in stocks and bonds. Some of the most popular investment apps include:

– Personal Capital

– Robinhood

– Acorns

– Wealthfront

Each of these investment apps has its own set of features and benefits. Choosing the investment app that best fits your needs and goals is essential.

How to Identify Your Needs and Goals with Free Financial Tools

When it comes to making money, you need to have a plan. This starts with identifying your needs and goals. You can do this by using free financial tools, such as:

– Personal Capital’s Retirement Planner

– The 50/30/20 Rule

– The Debt Reduction Calculator

By using these free financial tools, you can better understand how much money you need to save for retirement, how much debt you can afford to pay off, and how much you can spend each month without going into debt.

FAQs

What is tax-loss harvesting?

Tax-loss harvesting is selling investments at a loss to reduce how much you have to pay in taxes. This can be helpful if your investment portfolio has taken a big hit and you want to offset those losses with other gains, such as from stocks or bonds that are doing well.

For example, let’s say John has a portfolio worth $50,000. He sells investments worth $15,000 at a loss, which reduces his taxable income for the year by $15,000. This means he would only have to pay taxes on $35,000 of income instead of $50,000.

How do I know how much money I need to save for retirement?

You can use the Personal Capital Retirement Planner or other financial tools to help you determine how much money you need to save for retirement. Some of these tools will estimate how long it will take before your savings run out, which lets you adjust how much time and energy goes into saving today so that you don’t have to worry about it tomorrow.

Do all banks and credit unions offer personal capital financial planning services?

No, not all banks and credit unions offer the same financial planning services. For example, some banks might offer retirement planning services, while others might specialize in investment advice. It’s essential to do your research and find a bank or credit union that provides the services you need.

What are some of the most popular personal finance books?

Some of the most popular personal finance books include:

– The Millionaire Next Door

– The Richest Man in Babylon

– Your Money or Your Life

– The Automatic Millionaire

These books offer a variety of tips and advice for how to manage your money and achieve financial success. Reading one or more of these books can be a great way to get started on your journey towards financial independence!

How can I learn how much money is coming in and going out each month?

You can use a personal finance app like Mint or Personal Capital to track how much money you’re spending and how much income you’re making. These apps allow users to set up budgets so they don’t overspend their money or get into debt.

What is the best way to invest my money?

It depends on how much risk you’re willing to take and how long you want your investments to last. Some people prefer stocks because they can be more volatile and have a higher return rate than bonds do in general terms (the stock market is unpredictable).

Others might prefer bonds because they tend to be safer investments, with lower risk and lower returns over time.

How do I know how much money I need to save for retirement?

The best way to find out how much money you should save for retirement is by using a free financial tool like the Personal Capital Retirement Planner. This tool will help you estimate how long your current savings will last to make informed decisions about how much money to save each month.

What is a 401k?

A 401k is retirement savings account that lets employees contribute pre-tax dollars to their accounts. This means they don’t have to pay taxes on how much they put into the account until they withdraw it, which means their overall tax rate will be lower since less income will be taxed.

Is a savings account an effective personal capital account?

Yes, a savings account can be used as personal capital. It’s easy for people to save money because they don’t have to worry about how much is going in and how much will come out each month. They deposit their paycheck into the account every two weeks and then withdraw from it when needed (like groceries).

Which bank and investment accounts offer the highest returns?

It depends on how much risk you’re willing to take and how long you want your investments to last. Some people prefer stocks because they can be more volatile and have a higher return rate than bonds do in general terms (the stock market is unpredictable).

Others might prefer bonds because they tend to be safer investments, with lower risk and lower returns over time.

What is the best way to invest my money?

The best way to find out how much money you should save for retirement is by using a free financial tool like the Personal Capital Retirement Planner. This tool will help you estimate how long your current savings will last to make informed decisions about how much money to save each month.

What is the best personal finance app?

Mint and Personal Capital are great apps for budgeting and tracking how much money you’re spending/making each month. These apps allow users to set up budgets so they don’t overspend their money or get into debt-all while keeping track of how much money they have saved.

What is the best way to start saving money?

The easiest way to start saving money is by creating a budget and sticking to it. This means knowing how much money you’re making each month and how much you’re spending on necessities, luxuries, and debts.

From there, try to find ways to cut back on your spending so you can start saving more money.

What is the difference between a checking and savings account?

A checking account is a bank account where people deposit what they earn and use it to pay for groceries, bills, and rent quickly. A savings account is a bank account where people save their money to have it for emergencies or future investments.

What free tools are offered by banks to help manage my capital?

Banks offer free tools like budgeting apps and calculators that allow customers to see how much money they’re spending/making each month so they can make changes if necessary. Some banks also give out credit cards with cashback rewards programs, which help people earn back what they spend on purchases every day!

What is the best way to track how much money I am making?

The best way to track how much money you are making is by using a free tool like Mint or Personal Capital. These tools allow users to set up budgets, so they don’t overspend their money on things like groceries, bills, and rent while keeping track of how much they’re making each month.

What is the best way to invest my money long-term?

The best way to invest your money long-term is by investing in stocks and bonds. Stocks are a type of investment that gives people the opportunity to own a part of a company. They can be more volatile than other assets and have higher returns over time. Bonds are loans made between two parties. One party lends money to another party with interest paid back down the line (usually when it matures).

What is the best way to save for retirement?

The best way to save for retirement is by starting early. This means investing your money in a 401k or IRA account, so it has time to grow. It would help if you also aimed to save at least 15-20% of your income each month, so you have a solid financial foundation for retiring.

What are the different types of bank accounts?

There are several different types of bank accounts, including checking, savings, and investment accounts.

The main difference between checking and savings accounts is how easy it is for people to access their money. Checking accounts have fewer restrictions than savings, but both types allow customers to withdraw cash whenever they want from any ATM or branch location.

What are some different types of investments?

Many different kinds of investment options are available today, including stocks, bonds, real estate, and commodities.

Stocks are investments that give people the opportunity to own a part of a company. They can be more volatile than other assets and have higher returns over time.

Bonds are loans made between two parties. One party lends money to another party with interest paid back down the line (usually when it matures).

The Healthiest Breakfast: The Tastiest Way to Save Money

The Healthiest Breakfast: The Tastiest Way to Save Money January 16th, 2022 In the morning, it’s easy to grab a cup of coffee from your

How to Save Money When You’re Financially Stressed

How to Save Money When You’re Financially Stressed January 15th, 2022 It’s financially stressful when you’re in debt and living paycheck to paycheck. You want

Financial Goals – Examples of Short-Term Financial Goals

Financial Goals – Examples of Short-Term Financial Goals December 25th, 2021 What are examples of short-term financial goals? This is a question that many people