02/18/22

Finance Advice: Personal Finance & Personal Financial Situations

Personal Finance

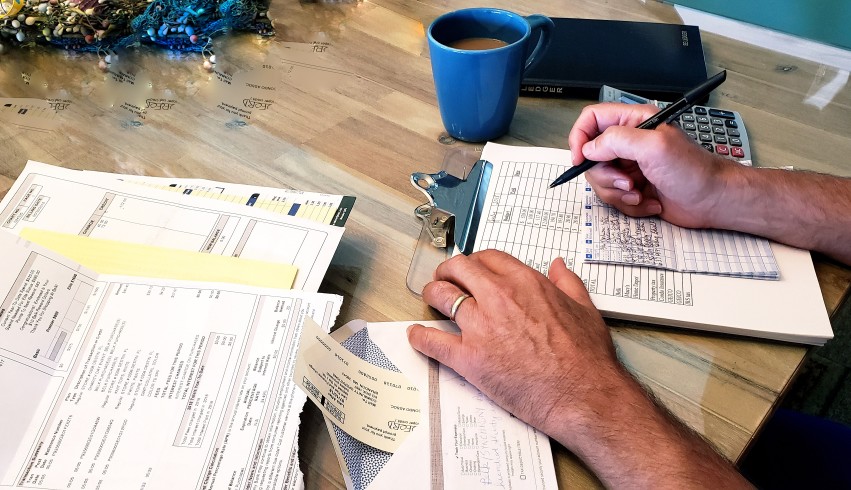

When it comes to finance, there are many things to think about. How do you save for retirement? What’s the best way to invest your money? How can you get out of debt? These are all important questions, and they deserve careful consideration. So if you’re looking for some helpful finance tips, you’ve come to the right place!

In this blog post, we will look at personal finance and personal financial situations. We’ll discuss different strategies for managing your money, and we’ll offer some advice on how to stay out of debt!

The Personal Finance Questions You Need to Ask Yourself

Before you can start managing your money effectively, you need to ask yourself some critical questions. What is your financial goal? How much do you owe in debt? Is your monthly income high enough?

These are all essential pieces of information that will help you create a personal finance plan. Once you have a plan in place, it will be easier to manage your money and achieve your financial goals.

The Questions

- Do you want to buy a house?

- Now that I’m retired with no mortgage or other debt payments, would it make sense?

- What are my current income sources, and how much will they provide for me in retirement?

- Do I have any money to pay off my mortgage or car loan if something happens to one of those two items before they ultimately pay off?

- What kind of investments should I make?

- Should I be investing in stocks, bonds, or mutual funds?

- What is the best way to save for my children’s college education?

- How much should I be saving each month, and what kind of account should I use?

- Should I have insurance on my house, car, health, or life?

- How much should I expect to pay for each policy, and what are the benefits?

- What is my risk tolerance?

- Do I want to take more risks with my investments, or am I more comfortable playing it safe?

You’ll need to answer just a few questions to create a personal financial plan that works for you and your family.

What Kind of Plan Do I Need?

Once you know what kind of financial goals you want to achieve, the next thing is figuring out how much money you need for each purpose. This will help us figure out how much money should go into our savings account.

We’ll also need to determine our investment risk tolerance, which will help us decide what kind of investments we should be making with our money (i.e., stocks vs. bonds). If we have children or other dependents, they may also factor into this equation!

How Much Should I Save?

One of the most important aspects of personal finance is saving for retirement. Ideally, it would be best if you were contributing as much money as possible to your 401k or IRA account. But even if you can’t contribute a lot of money each month, it’s still important to save something.

It’s also crucial to have an emergency fund that will cover at least three to six months’ worth of living expenses. This will help you avoid going into debt if something unexpected comes up.

So how much should you be saving each month? It depends on your income and financial goals, but a good rule of thumb is saving at least ten percent of your monthly income.

Debt Management

Debt management is another essential part of personal finance. If you have high-interest debt, it’s vital to start paying that off quickly. This will save you money in the long run and help you get your finances back on track.

There are a few different methods for paying off debt, so choose the best one for your situation. We recommend paying off the smallest debts first, then moving on to larger ones until all of them are gone.

Once you’ve paid off your debt, it’s time to start saving money again! You can do this by setting up automatic transfers from checking accounts or paychecks directly into savings accounts. Each month, a certain amount goes straight into savings without thinking about it.

What You Need to Know About Retirement Accounts

401k

A 401k account is sponsored by an employer, while an IRA account can be opened at any financial institution. With a 401k, employees contribute money directly from their paycheck before taxes are taken out – so it’s an easy way to save up for retirement without even thinking about it!

However, this type of plan limits how much money you can contribute per year (usually around $18K). IRAs have no such restrictions. You can open one at any financial institution and donate as little or as much money into them every single month – there’s no limit on how often you contribute throughout the year.

IRA

There are two different types of IRA accounts: Traditional and Roth. With a traditional IRA, contributions are tax-deductible when filing your income taxes each year; however, earnings aren’t taxed at withdrawal time, so it might not be the best option if you’re in a high tax bracket now.

Roths are better suited for people who expect to have lower income during retirement (since all contributions and earnings grow tax-free) but still want access to their money before 59 ½ years old without penalty fees or taxes on any withdrawals made before then.

Retirement Savings Tips

What are some tips for saving money on retirement? The first tip is to start planning as soon as possible. If you can, try putting away at least 15% of your income in an IRA or 401k account each year starting now so that it’ll be much easier later down the road when we have more expenses like a family and a mortgage to worry about.

Another great way to save money is by automating our retirement contributions. Many financial institutions let us set up an automatic withdrawal each month that’ll deposit a fixed amount of money into our IRA or 401k without even thinking about it!

We can also take advantage of employer matching programs, if available. Our employer will reach a certain percentage of what we contribute to our 401k account, like free money!

Finally, it’s essential to be mindful of fees. Many retirement accounts come with administrative and investment costs, so it’s worth shopping for the best deal. Try to find an account with low-cost investment funds and doesn’t charge any other fees such as an annual maintenance fee or monthly transaction charges.

The tips above are just some of the many ways to help us save up enough money for retirement. Still, we can also try out other ideas like investing in stocks and bonds or buying a property that generates rental income every month – all options worth exploring if we want to maximize our savings potential.

How This All Leads to Long-Term Financial Security

No one’s financial situation is the same, so it’s important to tailor our money management approach to fit our unique needs.

However, by following some or all of the advice mentioned in this post, we can start building a solid foundation for long-term financial security – whether we’re going through a tough time.

FAQs

How can I track applicable tax breaks?

There are many tax tracking tools available, such as TurboTax or TaxAct. These programs allow you to enter your information, and then they will calculate the amount of money you owe (or refunded) based on what deductions apply to your situation.

Is there an easy way to track stock quotes?

Yes! Many mobile apps allow you to track stock prices in real-time. One such app is Reuters Stock Quotes, which includes news stories related to any stocks you follow and can be downloaded for free from the App Store or Google Play Store.

Do I report my SEP IRA on my tax return?

SEP IRA contributions are not reported on your tax return. However, the earnings generated from your SEP-IRA account are taxable.

How does inflation affect when I retire?

Inflation is a general increase in prices over time, which means that the amount of money it takes today to purchase items will cost more tomorrow due to inflation. For example, if you retire at age 65 with $500k saved up and live another 15 years until 80 years old, your nest egg would need approximately $750k to maintain its purchasing power due to inflation.

Many financial advisors recommend retirees withdraw no more than four percent of their nest egg each year to account for the effects of inflation. This means that if our $500k nest egg shrinks down to only $250k after 15 years due to inflation, we would only be able to withdraw $10000 annually (instead of $20000) to maintain our standard of living.